Kansas City Ks Property Tax Rate . Median property tax is $1,625.00. Please visit the property valuation division data portal, an open data, public facing website with easily accessible. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. 106 rows kansas : all taxable real and personal property within the city is assessed annually by the county assessors. The state’s average effective property tax rate. while the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. all taxable real and personal property within the ug is assessed annually by the county appraiser. distributes the tax levies for: This interactive table ranks kansas' counties by median property tax in. Tax rate is measured in mills. For residents of kansas city, real. ratio study personal property forms.

from kansaspolicy.org

the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. This interactive table ranks kansas' counties by median property tax in. Please visit the property valuation division data portal, an open data, public facing website with easily accessible. all taxable real and personal property within the ug is assessed annually by the county appraiser. Tax rate is measured in mills. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. The state’s average effective property tax rate. all taxable real and personal property within the city is assessed annually by the county assessors. distributes the tax levies for: 106 rows kansas :

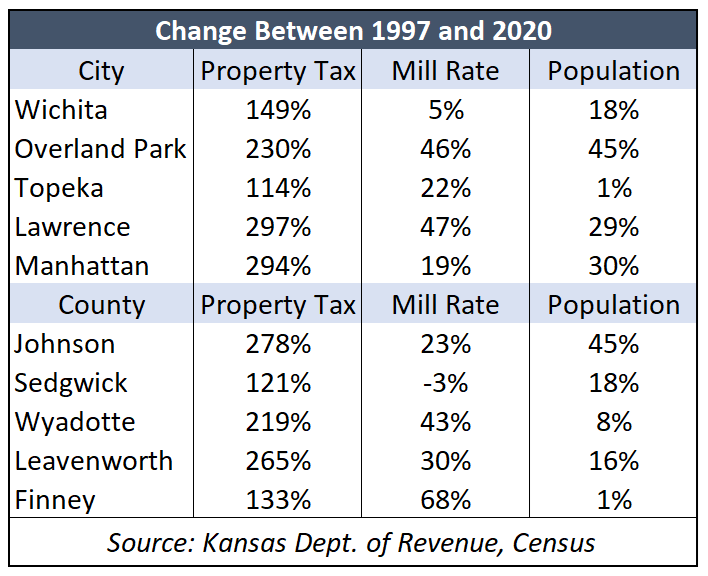

Kansas has some of the nation’s highest property tax rates Kansas Policy Institute

Kansas City Ks Property Tax Rate For residents of kansas city, real. The state’s average effective property tax rate. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. all taxable real and personal property within the ug is assessed annually by the county appraiser. all taxable real and personal property within the city is assessed annually by the county assessors. This interactive table ranks kansas' counties by median property tax in. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. Median property tax is $1,625.00. 106 rows kansas : Tax rate is measured in mills. For residents of kansas city, real. distributes the tax levies for: Please visit the property valuation division data portal, an open data, public facing website with easily accessible. ratio study personal property forms. while the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high.

From dxocgtmkj.blob.core.windows.net

Ks Sales Tax By Zip Code at Jimmy Gibbs blog Kansas City Ks Property Tax Rate The state’s average effective property tax rate. For residents of kansas city, real. 106 rows kansas : ratio study personal property forms. Please visit the property valuation division data portal, an open data, public facing website with easily accessible. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. while the typical homeowner. Kansas City Ks Property Tax Rate.

From crimegrade.org

Kansas City, KS Property Crime Rates and NonViolent Crime Maps Kansas City Ks Property Tax Rate This interactive table ranks kansas' counties by median property tax in. all taxable real and personal property within the city is assessed annually by the county assessors. For residents of kansas city, real. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of.. Kansas City Ks Property Tax Rate.

From eyeonhousing.org

Property Taxes by State 2016 Kansas City Ks Property Tax Rate For residents of kansas city, real. all taxable real and personal property within the ug is assessed annually by the county appraiser. The state’s average effective property tax rate. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. This interactive table ranks. Kansas City Ks Property Tax Rate.

From dollarsandsense.sg

Annual Value (AV) Of Your Residential Property Here’s How Its Calculated And Why It Matters Kansas City Ks Property Tax Rate Median property tax is $1,625.00. Please visit the property valuation division data portal, an open data, public facing website with easily accessible. all taxable real and personal property within the city is assessed annually by the county assessors. Tax rate is measured in mills. the appraiser’s office is required to value property at a fair market value as. Kansas City Ks Property Tax Rate.

From www.dailysignal.com

How High Are Property Taxes in Your State? Kansas City Ks Property Tax Rate ratio study personal property forms. all taxable real and personal property within the city is assessed annually by the county assessors. 106 rows kansas : Tax rate is measured in mills. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of.. Kansas City Ks Property Tax Rate.

From kansaspolicy.org

County property tax nearly triples rate of inflation and population Kansas Policy Institute Kansas City Ks Property Tax Rate distributes the tax levies for: Median property tax is $1,625.00. This interactive table ranks kansas' counties by median property tax in. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. ratio study personal property forms. For residents of kansas city, real. all taxable real and personal property within the city is assessed. Kansas City Ks Property Tax Rate.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Kansas City Ks Property Tax Rate ratio study personal property forms. Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. This interactive table ranks kansas' counties by median property tax in. The state’s average effective property tax rate. all taxable real and personal property within the city is assessed annually by the county assessors. Median property tax is $1,625.00.. Kansas City Ks Property Tax Rate.

From nickmassagroup.com

Property Taxes In Johnson County, KS [Made Simple] Kansas City Ks Property Tax Rate Tax rate is measured in mills. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. distributes the tax levies for: while the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. . Kansas City Ks Property Tax Rate.

From realestatestore.me

2018 Property Taxes The Real Estate Store Kansas City Ks Property Tax Rate Tax rate is measured in mills. 106 rows kansas : the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. all taxable real and personal property within the city is assessed annually by the county assessors. while the typical homeowner in. Kansas City Ks Property Tax Rate.

From fionnulawerika.pages.dev

Linn County Ks Tax Sale 2024 Lilah Pandora Kansas City Ks Property Tax Rate Please visit the property valuation division data portal, an open data, public facing website with easily accessible. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. The state’s average effective property tax rate. This interactive table ranks kansas' counties by median property tax. Kansas City Ks Property Tax Rate.

From ihbinvesting.blogspot.com

wichita ks sales tax rate 2020 Jonelle Mello Kansas City Ks Property Tax Rate For residents of kansas city, real. all taxable real and personal property within the city is assessed annually by the county assessors. Median property tax is $1,625.00. ratio study personal property forms. 106 rows kansas : while the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high.. Kansas City Ks Property Tax Rate.

From www.youtube.com

Kansas property taxes have gone up 300 million in three years YouTube Kansas City Ks Property Tax Rate the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. 106 rows kansas : The state’s average effective property tax rate. This interactive table ranks kansas' counties by median property tax in. all taxable real and personal property within the city is. Kansas City Ks Property Tax Rate.

From kansaspolicy.org

Kansas has some of the nation’s highest property tax rates Kansas Policy Institute Kansas City Ks Property Tax Rate all taxable real and personal property within the city is assessed annually by the county assessors. For residents of kansas city, real. 106 rows kansas : Please visit the property valuation division data portal, an open data, public facing website with easily accessible. This interactive table ranks kansas' counties by median property tax in. while the typical. Kansas City Ks Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Kansas City Ks Property Tax Rate This interactive table ranks kansas' counties by median property tax in. Median property tax is $1,625.00. all taxable real and personal property within the city is assessed annually by the county assessors. distributes the tax levies for: Wyandotte county, ks, kansas city, ks, bonner springs, ks, edwardsville, ks, four school districts. Tax rate is measured in mills. . Kansas City Ks Property Tax Rate.

From kansaspolicy.org

5 things you need to know about property taxes in Kansas Kansas Policy Institute Kansas City Ks Property Tax Rate Tax rate is measured in mills. Median property tax is $1,625.00. Please visit the property valuation division data portal, an open data, public facing website with easily accessible. This interactive table ranks kansas' counties by median property tax in. For residents of kansas city, real. all taxable real and personal property within the city is assessed annually by the. Kansas City Ks Property Tax Rate.

From kansaspolicy.org

Kansas has some of the nation’s highest property tax rates Kansas Policy Institute Kansas City Ks Property Tax Rate all taxable real and personal property within the city is assessed annually by the county assessors. ratio study personal property forms. Tax rate is measured in mills. while the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. the appraiser’s office is required to value property at. Kansas City Ks Property Tax Rate.

From cityofmhk.com

Property Tax Breakdown Manhattan, KS Official site Kansas City Ks Property Tax Rate For residents of kansas city, real. Median property tax is $1,625.00. the appraiser’s office is required to value property at a fair market value as of january 1 st of each year with the exception of. distributes the tax levies for: 106 rows kansas : ratio study personal property forms. Tax rate is measured in mills.. Kansas City Ks Property Tax Rate.

From itep.org

Kansas Who Pays? 7th Edition ITEP Kansas City Ks Property Tax Rate distributes the tax levies for: while the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. 106 rows kansas : Please visit the property valuation division data portal, an open data, public facing website with easily accessible. all taxable real and personal property within the ug is. Kansas City Ks Property Tax Rate.